Pittsburg County Oklahoma Property Taxes . 115 e carl albert pkwy # 102, mcalester, ok 74501. Enforces the collection of delinquent taxes through tax sales. access assessment records, ownership details, boundaries, and title searches. the median property tax in pittsburg county, oklahoma is $437 per year for a home worth the median value of $83,000. the pittsburg county assessor is responsible for appraising real estate and assessing a property tax on properties located in. the primary responsibility of the treasurer is to receive, manage, and invest all revenues received by pittsburg county government. prepares financial statements and financial records for review by state and county officials. view or pay tax info. Find lien records and visit the land records office for. location of treasurer's office:

from dxoidvjrj.blob.core.windows.net

115 e carl albert pkwy # 102, mcalester, ok 74501. the median property tax in pittsburg county, oklahoma is $437 per year for a home worth the median value of $83,000. location of treasurer's office: Find lien records and visit the land records office for. view or pay tax info. the primary responsibility of the treasurer is to receive, manage, and invest all revenues received by pittsburg county government. the pittsburg county assessor is responsible for appraising real estate and assessing a property tax on properties located in. prepares financial statements and financial records for review by state and county officials. access assessment records, ownership details, boundaries, and title searches. Enforces the collection of delinquent taxes through tax sales.

Pittsburg County Oklahoma Tax Assessor at Byron Love blog

Pittsburg County Oklahoma Property Taxes the median property tax in pittsburg county, oklahoma is $437 per year for a home worth the median value of $83,000. Enforces the collection of delinquent taxes through tax sales. location of treasurer's office: the primary responsibility of the treasurer is to receive, manage, and invest all revenues received by pittsburg county government. access assessment records, ownership details, boundaries, and title searches. prepares financial statements and financial records for review by state and county officials. the median property tax in pittsburg county, oklahoma is $437 per year for a home worth the median value of $83,000. Find lien records and visit the land records office for. view or pay tax info. the pittsburg county assessor is responsible for appraising real estate and assessing a property tax on properties located in. 115 e carl albert pkwy # 102, mcalester, ok 74501.

From ceswmzrn.blob.core.windows.net

Pittsburg Ok County Treasurer at Steve Banks blog Pittsburg County Oklahoma Property Taxes Find lien records and visit the land records office for. 115 e carl albert pkwy # 102, mcalester, ok 74501. the pittsburg county assessor is responsible for appraising real estate and assessing a property tax on properties located in. prepares financial statements and financial records for review by state and county officials. Enforces the collection of delinquent taxes. Pittsburg County Oklahoma Property Taxes.

From dxoidvjrj.blob.core.windows.net

Pittsburg County Oklahoma Tax Assessor at Byron Love blog Pittsburg County Oklahoma Property Taxes Enforces the collection of delinquent taxes through tax sales. Find lien records and visit the land records office for. the pittsburg county assessor is responsible for appraising real estate and assessing a property tax on properties located in. prepares financial statements and financial records for review by state and county officials. access assessment records, ownership details, boundaries,. Pittsburg County Oklahoma Property Taxes.

From www.landwatch.com

Mcalester, Pittsburg County, OK Recreational Property, Lakefront Pittsburg County Oklahoma Property Taxes access assessment records, ownership details, boundaries, and title searches. the pittsburg county assessor is responsible for appraising real estate and assessing a property tax on properties located in. the primary responsibility of the treasurer is to receive, manage, and invest all revenues received by pittsburg county government. view or pay tax info. the median property. Pittsburg County Oklahoma Property Taxes.

From www.landwatch.com

Mcalester, Pittsburg County, OK House for sale Property ID 415250276 Pittsburg County Oklahoma Property Taxes prepares financial statements and financial records for review by state and county officials. view or pay tax info. the pittsburg county assessor is responsible for appraising real estate and assessing a property tax on properties located in. location of treasurer's office: the median property tax in pittsburg county, oklahoma is $437 per year for a. Pittsburg County Oklahoma Property Taxes.

From ceswmzrn.blob.core.windows.net

Pittsburg Ok County Treasurer at Steve Banks blog Pittsburg County Oklahoma Property Taxes 115 e carl albert pkwy # 102, mcalester, ok 74501. Enforces the collection of delinquent taxes through tax sales. access assessment records, ownership details, boundaries, and title searches. Find lien records and visit the land records office for. location of treasurer's office: the pittsburg county assessor is responsible for appraising real estate and assessing a property tax. Pittsburg County Oklahoma Property Taxes.

From www.landsat.com

2015 Pittsburg County, Oklahoma Aerial Photography Pittsburg County Oklahoma Property Taxes Enforces the collection of delinquent taxes through tax sales. access assessment records, ownership details, boundaries, and title searches. prepares financial statements and financial records for review by state and county officials. the primary responsibility of the treasurer is to receive, manage, and invest all revenues received by pittsburg county government. the median property tax in pittsburg. Pittsburg County Oklahoma Property Taxes.

From www.landwatch.com

Mcalester, Pittsburg County, OK House for sale Property ID 338721124 Pittsburg County Oklahoma Property Taxes the primary responsibility of the treasurer is to receive, manage, and invest all revenues received by pittsburg county government. Enforces the collection of delinquent taxes through tax sales. access assessment records, ownership details, boundaries, and title searches. 115 e carl albert pkwy # 102, mcalester, ok 74501. location of treasurer's office: Find lien records and visit the. Pittsburg County Oklahoma Property Taxes.

From www.landonthehorizon.com

10 acres in Pittsburg County, OK Land on the Horizon Pittsburg County Oklahoma Property Taxes location of treasurer's office: the primary responsibility of the treasurer is to receive, manage, and invest all revenues received by pittsburg county government. the median property tax in pittsburg county, oklahoma is $437 per year for a home worth the median value of $83,000. Find lien records and visit the land records office for. 115 e carl. Pittsburg County Oklahoma Property Taxes.

From www.realtor.com

Indianola, Pittsburg County, OK Real Estate Indianola Homes for Sale Pittsburg County Oklahoma Property Taxes the median property tax in pittsburg county, oklahoma is $437 per year for a home worth the median value of $83,000. the pittsburg county assessor is responsible for appraising real estate and assessing a property tax on properties located in. the primary responsibility of the treasurer is to receive, manage, and invest all revenues received by pittsburg. Pittsburg County Oklahoma Property Taxes.

From www.landwatch.com

Canadian, Pittsburg County, OK Recreational Property, Undeveloped Land Pittsburg County Oklahoma Property Taxes the primary responsibility of the treasurer is to receive, manage, and invest all revenues received by pittsburg county government. 115 e carl albert pkwy # 102, mcalester, ok 74501. Find lien records and visit the land records office for. the pittsburg county assessor is responsible for appraising real estate and assessing a property tax on properties located in.. Pittsburg County Oklahoma Property Taxes.

From www.pinterest.co.uk

Pittsburg County, Oklahoma 1922 Map McAlester, OK Mcalester, Oklahoma Pittsburg County Oklahoma Property Taxes the median property tax in pittsburg county, oklahoma is $437 per year for a home worth the median value of $83,000. prepares financial statements and financial records for review by state and county officials. Enforces the collection of delinquent taxes through tax sales. the primary responsibility of the treasurer is to receive, manage, and invest all revenues. Pittsburg County Oklahoma Property Taxes.

From www.maphill.com

Political Map of Pittsburg County Pittsburg County Oklahoma Property Taxes prepares financial statements and financial records for review by state and county officials. Enforces the collection of delinquent taxes through tax sales. the median property tax in pittsburg county, oklahoma is $437 per year for a home worth the median value of $83,000. location of treasurer's office: the pittsburg county assessor is responsible for appraising real. Pittsburg County Oklahoma Property Taxes.

From www.flickr.com

Pittsburg County, Oklahoma Flickr Pittsburg County Oklahoma Property Taxes 115 e carl albert pkwy # 102, mcalester, ok 74501. Enforces the collection of delinquent taxes through tax sales. access assessment records, ownership details, boundaries, and title searches. Find lien records and visit the land records office for. the pittsburg county assessor is responsible for appraising real estate and assessing a property tax on properties located in. . Pittsburg County Oklahoma Property Taxes.

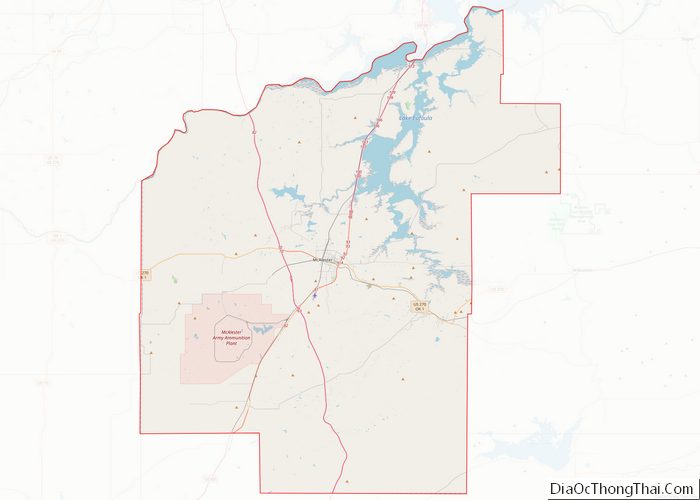

From diaocthongthai.com

Map of Pittsburg County, Oklahoma Địa Ốc Thông Thái Pittsburg County Oklahoma Property Taxes the primary responsibility of the treasurer is to receive, manage, and invest all revenues received by pittsburg county government. access assessment records, ownership details, boundaries, and title searches. the pittsburg county assessor is responsible for appraising real estate and assessing a property tax on properties located in. Enforces the collection of delinquent taxes through tax sales. 115. Pittsburg County Oklahoma Property Taxes.

From www.niche.com

Compare Cost of Living in Pittsburg County, OK Niche Pittsburg County Oklahoma Property Taxes the median property tax in pittsburg county, oklahoma is $437 per year for a home worth the median value of $83,000. the pittsburg county assessor is responsible for appraising real estate and assessing a property tax on properties located in. Find lien records and visit the land records office for. Enforces the collection of delinquent taxes through tax. Pittsburg County Oklahoma Property Taxes.

From www.landwatch.com

Tuskahoma, Pittsburg County, OK House for sale Property ID 415080545 Pittsburg County Oklahoma Property Taxes the primary responsibility of the treasurer is to receive, manage, and invest all revenues received by pittsburg county government. Enforces the collection of delinquent taxes through tax sales. Find lien records and visit the land records office for. 115 e carl albert pkwy # 102, mcalester, ok 74501. location of treasurer's office: access assessment records, ownership details,. Pittsburg County Oklahoma Property Taxes.

From www.realtor.com

Pittsburg County, OK Real Estate & Homes for Sale Pittsburg County Oklahoma Property Taxes Enforces the collection of delinquent taxes through tax sales. prepares financial statements and financial records for review by state and county officials. view or pay tax info. location of treasurer's office: the median property tax in pittsburg county, oklahoma is $437 per year for a home worth the median value of $83,000. 115 e carl albert. Pittsburg County Oklahoma Property Taxes.

From www.mappingsolutionsgis.com

Pittsburg County Oklahoma 1999 Wall Map Pittsburg County Oklahoma Property Taxes location of treasurer's office: access assessment records, ownership details, boundaries, and title searches. the pittsburg county assessor is responsible for appraising real estate and assessing a property tax on properties located in. 115 e carl albert pkwy # 102, mcalester, ok 74501. Find lien records and visit the land records office for. Enforces the collection of delinquent. Pittsburg County Oklahoma Property Taxes.